The Summit will take place in the Hague from 24-25 June, to discuss the framework for future cooperation and the level of defence spending

Later this month 32 NATO countries will gather in The Hague to discuss the framework for future cooperation and the level of defence spending. About 9,000 people are expected to attend the Summit, including some 45 heads of state and government from the 32 allies and partner countries. Additionally, 45 foreign ministers and 45 defence ministers will participate, along with about 6,000 representatives from various nations and 2,000 journalists.

The war in Ukraine and shifting geopolitical realities have dramatically changed perspectives in recent years. There is now a fundamentally different understanding of why and how defence investments must be made. We live in a world in which Russia has invaded Ukraine; China counts Russia, North Korea, and Iran as allies; and these countries support Russia’s invasion of Ukraine.

For those working in telecommunications, it’s worth asking how these developments relate to the industry and how NATO’s work might impact telecom operators across and perhaps beyond the alliance. This note provides insight into the ongoing developments and our perspective on what lies ahead.

Setting the course

In 2023 Warren Low, Digital Backbone Programme Manager and Experimentation Director who oversees 5G projects at NATO Allied Command Transformation said, “5th Generation mobile telecommunications technologies were developed to provide transformational opportunities in the civilian sector, but they also have the potential for military applications. The use of 5G, virtual and augmented reality can help the armed forces learn and use complex military equipment.”

NATO Allied Command Transformation and the Latvian Ministry of Defence conducted the “Digital Backbone Experimentation 2024” (DiBaX) during October 21-November 1, 2024. DiBaX demonstrated the use of technologies that can enable Multi-Domain Operations within the Alliance and is a pioneering NATO experimentation aimed at enhancing interoperability across domains through cutting-edge 5G and satellite communication technologies. The project reflects NATO’s commitment to strengthening defence capabilities in an interconnected world.

Strand Consult believes that these experiments will set the course for how mobile operators and defence forces will work together in the future and cited the recent example of the transnational project of Nordic defence forces cooperating with advanced 5G military applications and 5G slicing.

5G’s central role

Given technological requirements, there is no doubt that the 5G mobile infrastructure that exists in all countries will play a central role in the communication solutions used by the Armed Forces. Mobile operators in Norway, Sweden and Finland, together with the national defence and NATO, show how it can be done.

The NATO exercise Joint Viking 2025 in Bardufoss, a remote part of Norway above the Arctic Circle, tested advanced defence applications and provided real-time information to field personnel via the commercial 5G networks. It was an exercise involving more than 10,000 soldiers from Belgium, Canada, Finland, France, Germany, US, UK, the Netherlands and Norway.

5G mobile infrastructure can upgrade military communications with applications for C2, ISR, UAVs, AR/VR and Smart Logistics and IoT. Mobile operators in Norway, Sweden, and Finland, together with their national defence forces and NATO, show how this can be done.

Such cooperation between NATO, the Armed Forces and commercial telecommunications companies will likely be expanded in the coming years. Commercial telecommunications networks will likely be included in the EU’s €800 billion plan “ReArm Europe Plan/ Readiness 2030.”

Telecoms part in rearmament

Modern militaries cannot function without secure, advanced, and integrated communications. 5G is the go-to solution for its speed, security, and adaptability. Indeed, private 5G networks are explored for ways for NATO and allied militaries can utilize mobile networks operated by private companies.

NATO does not use equipment from countries like China, Russia, North Korea, or Iran. Indeed, NATO’s procurement rules prohibit its contracting with communist countries. NATO would not purchase Chinese fighter jets from Chengdu Aircraft Corporation and Shenyang Aircraft Corporation, nor Huawei network equipment. The rationale is that ill-advised to acquire critical supplies from one’s adversary. Think only of the Greeks’ gift of the Trojan Horse.

A mobile operator must seamlessly integrate its 5G communication solutions with those used by individual NATO countries to effectively support military operations. This capability was successfully demonstrated during the NATO exercise Joint Viking 2025.

The key question now is which mobile operators will be selected to provide these critical solutions and which will be excluded. Equally important is whether some countries will be unable to offer such advanced solutions to their national defence and NATO allies because of security concerns.

Choices have consequences

The operators in NATO countries which have chosen to use equipment from Huawei and ZTE are unlikely to be invited as suppliers. Such decisions are likely to deem a network solution as untrustworthy and disqualify the provider to deliver communication solutions to the military.

Since 2018, Strand Consult has analysed and mapped the use of Chinese technology in mobile networks across 61 countries. The 2025 update is here: Is there a correlation between European nations’ level of Chinese telecom equipment, the consumption of Russian energy, and military aid to Ukraine?

A significant number of operators have chosen to use Chinese equipment in all or parts of their networks. Some of the largest Europe operators will probably not qualify as suppliers to NATO.

In 2023 Commissioner Thierry Breton announced EU would limit procurement of telecom services from operators that don’t comply with the EU’s 5G Toolbox, especially those using Chinese technology to build and operate their networks.

The EU’s Cybersecurity Risk Evaluation and Scenarios emphasise telecommunications security. This work, among other efforts, forms the foundation of the 5G Toolbox and the EU’s stance on the use of Chinese equipment in critical infrastructure.

Separating operators into two groups

European mobile operators will increasingly be divided into two groups: those qualified to supply NATO, the EU and other entities requiring secure communications, and those that don’t.

Operators failing to meet these requirements will likely face a competitive disadvantage, as their rivals use security certifications from authorities and NATO as selling points to customers which demand trusted communication services.

The presence of risky equipment in a network could also inhibit the use of cutting-edge AI application providers like Datenna, Thales, Czechoslovak Group (CSG), Palantir, Anduril, Skydio and Shield AI.

The defence sector faces a significant challenge in several countries. Germany stands out as a problematic case.

In Strand Consult’s recent mapping of Chinese telecom infrastructure across 31 European countries, countries like Germany, Italy, and Cyprus have no single national network free from Chinese equipment.

From a NATO perspective, Germany is Europe’s biggest current challenge. Here are the cold facts about Germany:

- Approximately 25% of mobile customers in Europe are German, representing 20% of the EU population — a serious concern in itself and one which suggests the German government does not take the threat from untrusted vendors seriously.

- Germany accounts for 29% of the EU’s GDP.

- Germany is now Europe’s top defence spender, according to SIPRI arms data.

- In 2020, 57% of Germany’s 4G Radio Access Network (RAN) equipment was sourced from untrusted vendors; today, 59% of installed 5G RAN equipment is from such vendors.

- There is not a single national mobile network in Germany free from Huawei equipment.

- Deutsche Bahn, which connects not only Germany but also much of Europe’s heavy industry, is 100% dependent on Huawei equipment.

- The cloud solution provided by T-Systems to its customers is built and partly operated by Huawei for Deutsche Telekom.

- Reports suggest Germany has not taken the security risks posed by China seriously. It resembles the Nord Stream 2 situation — but for communications infrastructure.

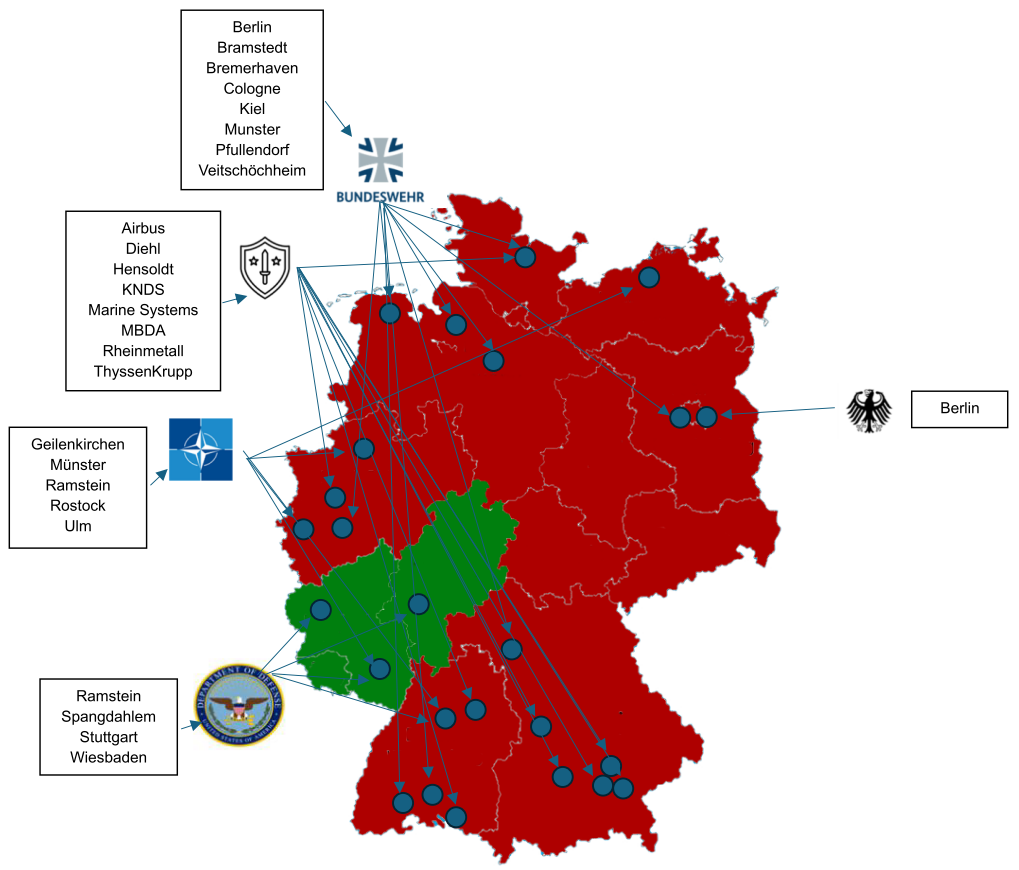

Neither the German military, NATO, nor the 35,000 U.S. troops currently stationed in Germany can access a commercial network that isn’t built on technology from Chinese suppliers such as Huawei and ZTE.

The following map details Germany’s challenges.

In Germany, 59% of mobile network RAN equipment comes from Huawei and ZTE. As a consequence, most of the mobile network infrastructure is classified as untrusted vendors, according to the EU and NATO standards. Based on the public data, Strand Consult provides the map of Germany below.

It highlights the three major military bases for the US and NATO including Bundeswer and the leading weapons manufacturers are located. The three commercial mobile networks are superimposed on the map by color indicating the origin of the mobile network equipment.

The federal states Saarland, Rhineland-Palatinate, and Hesse are the only areas with 100% trusted network equipment. As for the rest of Germany, Huawei and/or ZTE supplies 5G RAN to at least one mobile network.

Taken from the other perspective, the three Chinese mobile operators don’t use Western 5G RAN equipment it is mobile networks. The Chinese military have access to three Huawei/ZTE based networks.

Such trusted network maps can provide insight to EU and NATO to access mobile network to security across the 32 NATO countries. In Europe, only a handful of countries have made to shift to trusted networks and opted out of Chinese 5G infrastructure, including Denmark, Sweden, the Baltic States and a few others.

Forced onto networks run on Chinese tech

Every time US Army Europe and Africa’s Commanding General Christopher Donahue, his staff, or his family use a mobile phone in big part of Germany, their traffic is routed through a mobile network that relies on Chinese technology. General Donahue and everyone else in Germany simply does not have access to a national network free from Chinese government-linked infrastructure.

To be clear, the new German government has started taking defence more seriously. In late March, the Bundestag approved a historically large investment in defence:

From the outside, however, it is concerning that Germany, a crucial pillar of NATO cannot implement the secure communications solutions NATO has recently tested. One example is the Joint Viking 2025 exercise mentioned above, which trialed advanced defence applications and real-time information sharing via commercial 5G networks built and operated by secure private actors. That exercise involved more than 10,000 troops.

NATO will likely address this issue, and it unlikely that NATO’s defence apparatus would rely on 5G solutions built on Chinese infrastructure. What’s unfolding in the European part of NATO will eventually catch Washington’s attention. It’s striking that the Pentagon is helping implement secure military communication systems in Europe that aren’t even used domestically in the US.

Impact for operators

The geopolitical reality demands that mobile operators consider their security policy with some fundamental distinctions:

- Operators in countries that view China as a military partner, and

- Operators in countries that do not view China as military partner.

Russia, Iran, and North Korea all fall into the latter category and so do the operators that serve them. Russia, in fact, has a ‘No Limits’ military partnership signed with China in 2022.

If your mobile network uses Huawei and ZTE, it is unlikely to be considered a secure provider of communications solutions for NATO defence.

Conclusion

The world is changing rapidly. China is not the same country it was 10 years ago. Today, China considers Russia, Iran and North Korea its allies. These countries seek to undermine democracies in the free world.

China assists Russia in its war on Ukraine. Chinese mobile network providers delivered 4G networks to Crimea after Russia’s 2014 invasion. Thousands of North Korean soldiers are fighting on Russia’s side in the war against Ukraine. War is being waged on European soil with the tacit approval of the Chinese government.

Daily news reports describe how Chinese government affiliated hackers target critical infrastructure, including telecommunications, energy systems, government departments and public officials. A Chinese ship has been implicated in sabotage of a subsea cable near Taiwan. These represent China’s increasingly sophisticated campaign of electronic warfare.

Strand Consult foresaw this development in its 2019 research note “Telecoms operators’ next big challenge is the 100,000 Chinese hackers attacking their corporate customers every day.”

Recently the European Union and its Member States, together with international partners, expressed solidarity with Czechia following a malicious cyber campaign that targeted its Ministry of Foreign Affairs. Czechia determined that the cyberattack was carried out by Advanced Persistent Threat 31 (APT31), a group associated with the Chinese government.

Tapping commercial mobile operators

Going forward, commercial mobile operators are likely to be tapped to deliver an increasing share of the communications solutions used by the military. This will happen through partnerships involving the national defence sector and the mobile operators that build and operate national mobile networks.

Operators that have chosen to use equipment from suppliers like Huawei and ZTE are unlikely to meet the security requirements. The qualification review and exercise which will be undertaken among the 32 NATO countries and many other nations around the world aligned with NATO, countries like Japan, the Philippines, and many others.

In countries which China considered a military partner, defence authorities likely have no issue using equipment from Huawei and ZTE. Such nations could include Pakistan, Belarus, and Cambodia.

Strand Consult has identified 8 risks in the 5G supply chain from suppliers under the undue influence of adversarial countries like China. See more in our December 2024 note.

What to Expect for the Future

The EU’s 5G Toolbox is a starting point. As 5G networks connect critical systems, energy, water, transport, and industry its security is vital for security, autonomy, and national defence. Beyond mobile networks, Denmark and others are applying this risk assessment approach to broader telecom and infrastructure systems.

A new Danish law directs assessment of telecommunications equipment and requires removal of equipment from non-trusted vendors. This Investment Screening Act forms the foundation for the Danish National Strategy for Cyber and Information Security. The assessment is performed by The Centre for Cyber Security (CFCS).

This research note originally appeared on the Strand Consult website and is reproduced here in full with kind permission of Strand Consult.

For more discussion of the security policy, see Strand Consult CEO John Strand’s presentation in the Senate of Spain, The new geopolitical reality: how to build and protect information society infrastructure.